Student Loan Forgiveness is certainly on the minds of many of my readers this month! As there have been a number of changes in the past few weeks, I wanted to share with you the most important updates, especially since they are time sensitive.

If you are interested in pursuing the Student Loan Forgiveness Program, this is what you should know:

- {Time Sensitive} Public Service Loan Forgiveness Program:

The Public Service Loan Forgiveness program currently has broader eligibility for a very limited time (until the end of the month). This program is designed to help teachers, nurses, and firefighters who had FFEL or Perkins program loans.

Note–this program is different from the one-time student loan forgiveness plan, but provides loan forgiveness to those in public service who have made 120 qualifying payments.

If you work in public service, with a long history of repayment, you may be eligible for the Public Service Loan Forgiveness (PSLF) program. Currently, the rules for who is eligible are currently broader than before, but these temporary changes expire October 31, 2022, and the process has multiple steps, so you will definitely want to start soon! For more details about the program go here. - Student Loan Forgiveness Reversal in Eligibility:

In a recent reversal of language by the Education Department, borrowers with federal student loans not held by the Department of Education are no longer eligible to obtain one-time debt relief by consolidating those loans into Direct Loans. This means approximately 770,000 people will now be excluded from this program.

How do you know if your student loan is held by the Department of Education? Once you have registered on the StudentfAid.gov website, find the “My Loan Servicers” section. If the servicer name starts with “Dept. of Ed,” the loan is held by the Department of Education.

- Who is Eligible for the One-Time Debt Forgiveness?

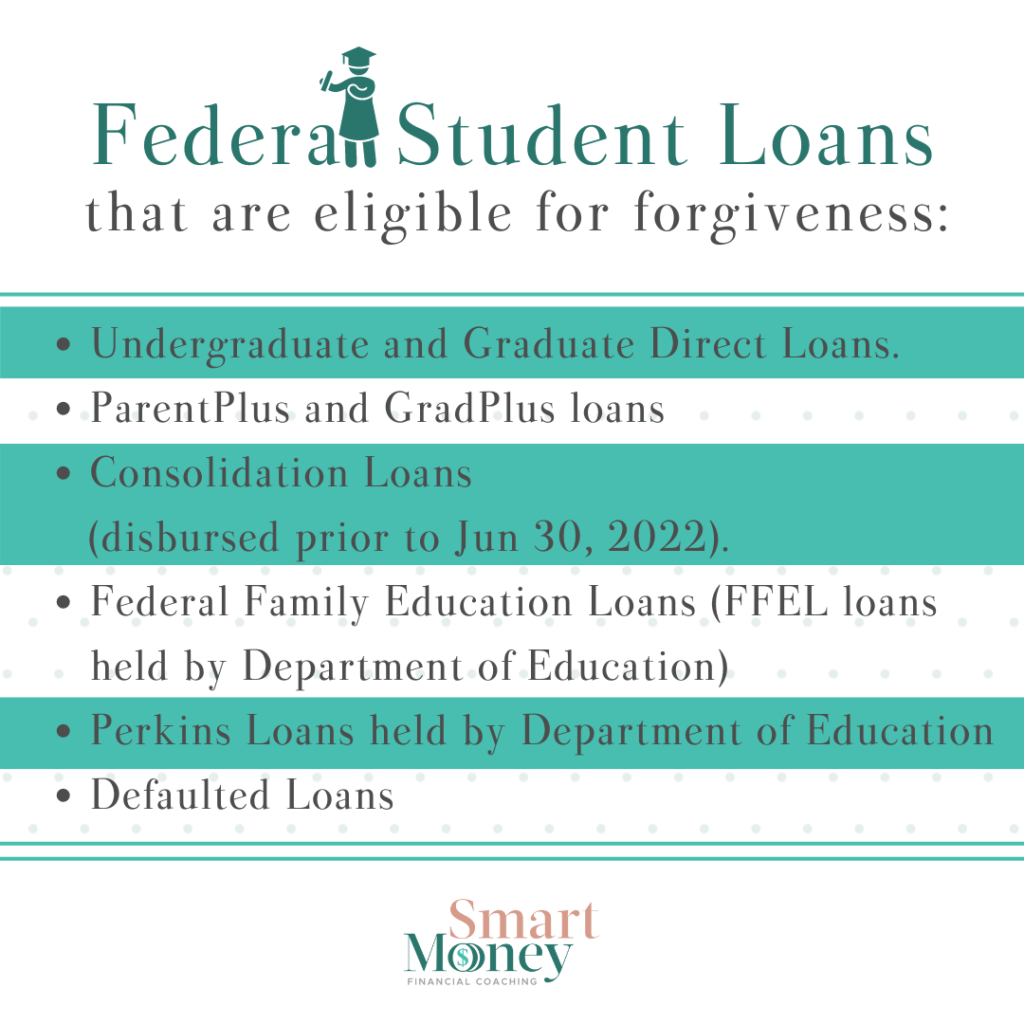

While eligibility could change, as of this writing, here are the Federal Student Loans that are eligible for forgiveness:

- Undergraduate and Graduate Direct Loans.

- ParentPlus and GradPlus loans

- Consolidation Loans (disbursed prior to Jun 30, 2022).

- Federal Family Education Loans (FFEL loans held by Department of Education)

- Perkins Loans held by Department of Education

- Defaulted Loans (includes loans held by the Department of Education or commercially serviced Subsidized Stafford, Unsubsidized Stafford, parent PLUS, and graduate PLUS; and Perkins loans held by Department of Education.)

If you are interested in applying for the Student Loan Forgiveness Program, as I mentioned last month, I would highly recommend setting up your account on the StudentAid.gov. Additionally, you can sign up for notifications from the Department of Education here.

We are expecting to hear that applications will be open soon, and once your application is received, they are anticipating a 4-6 week turnaround time. Expect that rules and eligibility are likely to change in the coming weeks. If you are interested in the student loan forgiveness, I recommend that you apply for it, even if you are not quite sure if you qualify.

As there are changes, I will keep you posted. Let me know what questions you have! I am happy to help guide you through this process.